Simplified depreciation calculator

Subtracting 20 means you can depreciate 240000 of the purchase price. You will only need to pay the greater of either your.

Depreciation Schedule Formula And Calculator Excel Template

10 rows It merely simplifies the calculation and recordkeeping requirements of the allowable deduction.

. A quick and clear explanation on how to calculate depreciation using straight line method and reducing balance method. Standard deduction of 5 per. Section 179 Tax Deduction calculator an easy to use calculator to estimate your tax savings on equipment purchase through section 179 deduction in 2019 and tax year 2018.

Free simplify calculator - simplify algebraic expressions step-by-step. First one can choose the straight line method of. To work out the decline in value of the depreciating assets in a low-value pool add.

March 2022 index 4138 divided by March 2021 index 3881 indexation factor of 1066. The simplification calculator allows you to take a simple or complex expression and simplify and reduce the expression to. Enter the expression you want to simplify into the editor.

1875 of both the taxable use percentage of the cost of low-cost assets you allocated to the pool during. If you use the simplified method for one taxable year and use the standard method for any subsequent year you must calculate the depreciation deduction for the subsequent year. This depreciation calculator is for calculating the depreciation schedule of an asset.

Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of SalvageCost1Life Variable Declining Balance Depreciation. Alternative minimum tax AMT calculator with deductions and estimates your tax after exercising Incentive Stock Options ISO for 2022. Determining whether a business is a small entity depends on the businesss aggregated turnover not geographical location or number of staff.

That means the total deprecation for house for year 2019 equals. You can use this tool to. Depreciation Factor for the month of May 1605.

270000 x 1605 43335. Highlights of the simplified option. To use the simplified.

Use this free car depreciation calculator to get an idea of how much your car could be valued at and how much it will likely depreciate over the years. Immediately write off or claim the full cost of most depreciating assets costing less than 20000 the current instant asset write-off threshold in the year you buy them or Pool. Then you notice the property has a leaky roof so you have a new one installed for 20000.

It provides a couple different methods of depreciation. Calculate the depreciation amounts for. Again this isnt a.

Your small business pool. For the 2021-22 year the cost limit is 60733.

Simplified Home Office Deduction Explained Should I Use It

Real Estate Depreciation Meaning Examples Calculations

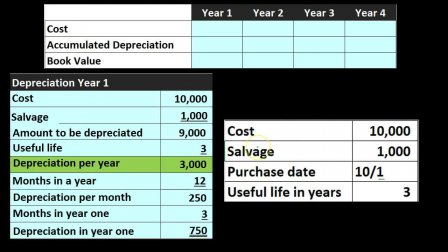

Calculating Depreciation Youtube

/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

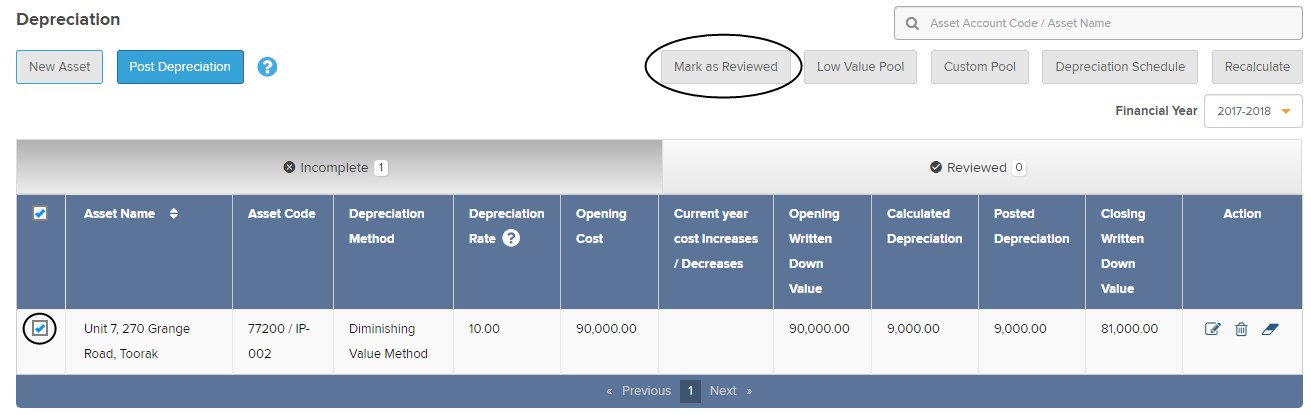

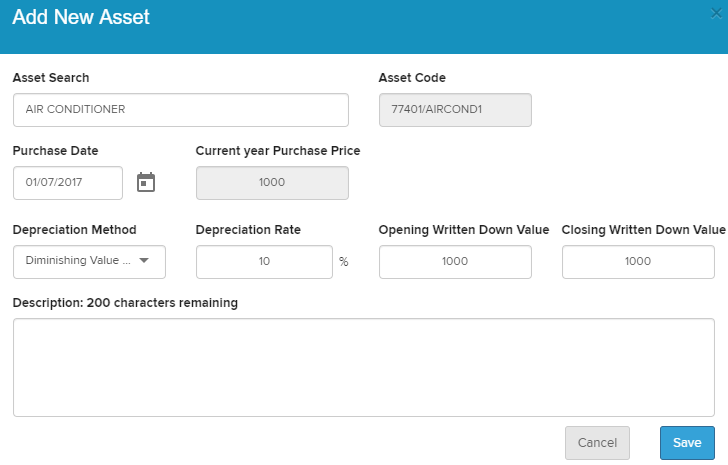

Depreciation Schedule Simple Fund 360 Knowledge Centre

Depreciation Calculator For Home Office Internal Revenue Code Simplified

Financial Accounting Depreciation Calculation Fixed Assets Robert Steele Skillshare

Depreciation Schedule Template For Straight Line And Declining Balance

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

An Excel Approach To Calculate Depreciation Fm

/StraightLineBasis-bfb937d99f9d49ac9a15b8f78ca3b1a0.jpg)

Straight Line Basis Definition

Depreciation Schedule Formula And Calculator Excel Template

Depreciation Schedule Formula And Calculator Excel Template

The Best Guide To Maximising Small Business Depreciation Box Advisory Services

Method To Get Straight Line Depreciation Formula Bench Accounting

Depreciation Schedule Simple Fund 360 Knowledge Centre

How To Calculate Depreciation Youtube