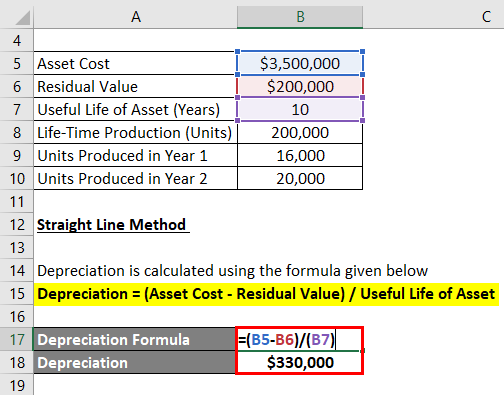

Depreciation formula example

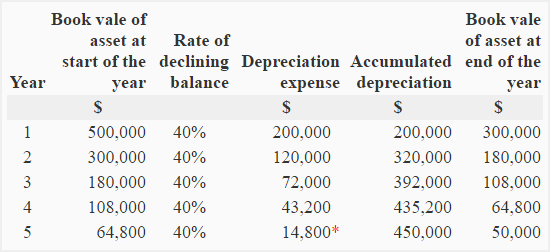

Depreciation rate 1 Assets useful life x 100 Once calculated companies use the same rate for each asset in that class. Depreciation Formula for the Straight Line Method.

Depreciation Formula Calculate Depreciation Expense

Annual depreciation 2000 500 5 years 1500 5 years 300 According to straight-line depreciation the computer depreciates by 300 every year.

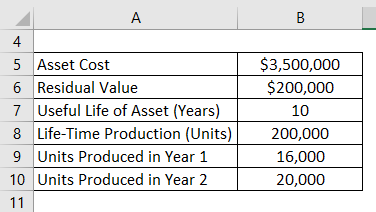

. Depreciation refers to the cost of an asset spread over its useful life. The straight-line method for annual depreciation can be calculated using the formula. Assume a business buys a machine for INR 1crore with a useful life of 25 years and a salvage.

Consider a piece of equipment that costs 25000 with an. Tax Shield Formula Step By Step Calculation With Examples So for instance if you have 1000 in mortgage interest and your. You can also prepare a depreciation schedule in Excel using the Units of Production methods.

Depreciation Expense Cost Salvage value Useful life. Annual depreciation cost residual value year of useful life. The depreciation for one period using units of production method is.

It also represents the reduction in the record cost of that asset in a systematic way. This rate then goes into various depreciation. Depreciation Formula Examples With Excel Template Determine the cost of the asset.

The plant can be sold at Rs50000 at the end. The depreciation so calculated is to be charged over the life and. Once calculated companies use the same rate for each asset in that class.

The useful life of the plant is 10 years. Depreciation fracCost of asset Residual valueUseful life Rate of depreciation fracAmount of depreciationOriginal cost of asset x 100. Depreciation Value of Asset Salvage Value Life of Asset.

Depreciation tax shield formula. For instance if the tax. Calculate the Depreciation by applying the formula.

Purchased a boiler plant for Rs800000. Straight Line Depreciation Formula Example 1. Suppose if the cost of a motor is rs20 000 its useful life is 4 years and scrap value is Rs2000 the annual.

Straight-line depreciation Original value Salvage ValueUseful Life. SLM Annual depreciation expense Original cost of asset - Salvage value of asset.

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Depreciation Formula Examples With Excel Template

Double Declining Balance Depreciation Calculator

Depreciation Formula Examples With Excel Template

Depreciation Rate Formula Examples How To Calculate

How To Use The Excel Db Function Exceljet

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Declining Balance Method Of Depreciation Definition Explanation Formula Example Accounting For Management

How To Use The Excel Syd Function Exceljet

Depreciation Calculation

Annual Depreciation Of A New Car Find The Future Value Youtube

Depreciation Calculator

Depreciation Of Fixed Assets Double Entry Bookkeeping

Depreciation Formula Examples With Excel Template

Straight Line Depreciation Formula And Calculation Excel Template